The Buzz on R 22 Alternative

Table of ContentsNot known Details About R 22 Alternative Some Of R 22 AlternativeGetting My R 22 Alternative To WorkExamine This Report about R 22 Alternative

Home insurance may also cover medical expenses for injuries that individuals sustained by being on your home. When something is damaged by a calamity that is covered under the residence insurance coverage plan, a home owner will certainly call their house insurance coverage business to file a claim.

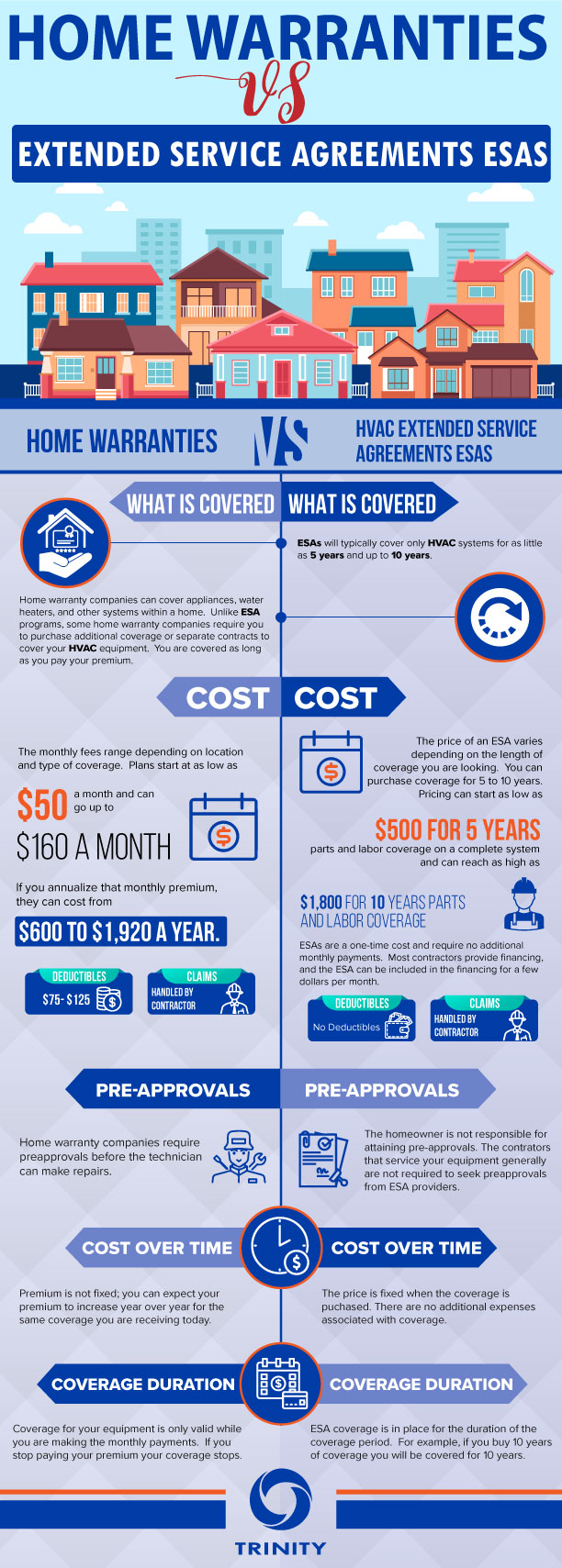

Another distinction between a home service warranty and also house insurance is that residence insurance policy is typically required for homeowners (if they have a home mortgage on their house) while a home service warranty strategy is not required. A residence guarantee and residence insurance coverage offer protection on various parts of a residence, as well as together they can shield a home owner's spending plan from pricey repair services when they undoubtedly turn up.

R 22 Alternative for Beginners

If there is damage done to the structure of your home, the owner won't need to pay the high prices to repair it if they have house insurance policy. If the damage to the house's framework or property owner's items was produced by a malfunctioning home appliances or systems, a residence warranty can assist to cover the expensive fixings or replacement if the system or appliance has fallen short from regular wear and tear.

They will work with each other to give defense on every part of your home. If you're interested in buying a house service warranty for your residence, take a look at Landmark's house guarantee strategies and also rates below, or demand a quote for your house below.

In you could check here a best-seller's market where house purchasers are forgoing the house examination backup, acquiring a residence service warranty can be a balm for bother with possible unknowns. To obtain one of the most out of a house guarantee, it is very important to check out the fine print so you understand what's covered and how the strategy functions before registering.

The difference is that a home service warranty covers an array of products rather than simply one. There are three basic kinds of house warranty strategies.

See This Report about R 22 Alternative

Some things, like in-ground sprinklers, pool and septic systems, might require an extra warranty or may not be covered by all residence warranty business. When contrasting home guarantee firms, see to it the plan alternatives encompass whatever you would certainly desire covered.New building and construction homes typically featured a warranty from the home builder.

Building contractor warranties normally do not cover devices, though in a brand brand-new house with brand-new devices, makers' warranties are most likely still in play. If you're obtaining a house service warranty for a brand-new home either new building or a house that's brand-new to you insurance coverage usually starts when you close.

In other words, if you're buying a residence and also an issue comes up during the residence evaluation or is noted in the vendor's disclosures, your residence guarantee business may not cover it. Instead of relying exclusively on a warranty, try to work out with the seller to either remedy the issue or offer you a credit to aid cover the price of having it taken care of.

You do not have to study and also get recommendations to locate a tradesperson whenever you need something dealt with. The other hand of that is that you'll get whomever the residence guarantee firm sends out to do the assessment and make the repair service. You can't pick a specialist (or do the work on your own) and after that get repaid (r 22 alternative).

A Biased View of R 22 Alternative

For one, house owners insurance policy is needed by lending institutions in order to get a home mortgage, while a residence service warranty is totally optional. As stated above, a house guarantee covers the repair service as well as replacement of products and systems in your home.

Your house owners insurance, on the various other hand, covers the unexpected. It won't aid you change your devices because they obtained old, yet home owners insurance policy might assist you get new home appliances if your existing ones are harmed in a fire or flooding.

How much does a residence service warranty cost? House guarantees normally set you back in between $300 as well as $600 each year; the expense will differ relying on the type of strategy you have. The a lot more that's covered, the more you can check here expensive the plan those attachments can build up. Where you live can also influence the expense - r 22 alternative.

You won't pay for the real fixings, you will pay a solution cost each time a tradesperson involves your home to examine a concern. If greater than one pro is called for, you might finish up paying a service charge even more than once for the exact same work. This fee can range from regarding $60 to $125 for each and every service instance, making the service why not try here charge an additional factor to consider if you're buying a house service warranty strategy.